How to Raise Venture Capital in 2026 (Complete Guide)

.avif)

We all know that raising venture capital is difficult and not only is it difficult, but it's also an ever-changing landscape.

You’re probably well aware craziness that went on in 2021, when venture capital was relatively easy to obtain. with millions of dollars going in every direction backing practically any startup with a little traction or a functioning MVP.

But it's not 2021 anymore, in fact it's about to be 2026, it’s been 3 years since the VC frenzy and the market has leveled out quite a bit.

And with a new landscape requires an entirely new set of tactics to raise capital. With that said, we wanted to make sure that we updated our guide to raising venture capital for all of you founders raising rounds in the new year.

We’ve helped tons of companies raise capital and this guide shares the process and tactics that we’ve found to be the most effective. This includes everything like the fundraising process, pricing your round, and even the sales funnel used to track your investor pipeline.

Now, let’s dive into how to raise capital in 2026.

Bookmark This Guide

To start, be sure you bookmark this guide because fundraising takes time and you’ll want to reference it throughout your fundraising process.

Get a Head Start

This guide is extremely helpful, but it can only do so much for you. If you are serious about raising capital, we recommend getting started months beforehand. This will allow you to build relationships with founders who can make potential introductions for you. It will also allow you to build relationships with investors, making it easier to book meetings down the road.

In general, you should get started years before even beginning your fundraising process. But in most cases, 3 to 6 months will be enough time to build these relationships.

What to Know Before Getting Started

When you’re first raising venture capital, you need to make sure you’re approaching the right investors.

Different investors invest at different stages, so here is a quick overview of the right investors to search for based on your stage:

Pre-Seed Rounds

Description: Very early stages companies with a prototype or working product but limited users or traction.

Round Size: $50K - $2mm ($1mm is the median according to Crunchbase data)

Ideal Investor Profile: Accelerators, Angel Investors, Angel Groups, & Micro VCs

Seed Rounds

Description: Startups with a working product and some paying customers and indication of potential growth. This also applies to founders with past successful exits.

Round Size: $500k - $5mm ($2.3mm is the median for 2023 )

Ideal Investor Profile: Angel Groups, Micro VCs, & Early Stage VCs

Series A Rounds

Description: Series A rounds are for startups that have successfully proven that there is a need for their product. You’ll often hear VCs say that they only invest in a Series A after a company has reached $1mm+ ARR. Although they may invest at a lower ARR if there is significant growth in recent months.

Round Size: $2mm-$30mm ($12mm is the median for 2023)

Ideal Investor Profile: Venture Capital & Private Equity

Pricing Your Round in 2024

Before we dive into pricing your round, it's important to know that Seed and Series A fundraises operate entirely differently.

Series A rounds generally have a lead investor who sets the valuation or price of the round. That valuation is what will be offered to all other investors in this round. In this case, your task is to lock in a lead investor and negotiate a price with them. It’s difficult to accomplish but it’s a straightforward approach that determine the details of the round.

Seed funding, on the other hand, is different. In general, Seed rounds do not have a lead investor and are most often raised using a SAFE or convertible note with a valuation cap. In most cases, you can simply think of the valuation cap as the valuation of the startup.

So if there is no lead investor in a Seed round, who sets the price or valuation cap?

When It comes to pricing your startup, the traditional thought process is to “let the market decide”. This entails pinning investors against each other to create a bidding war and maximizing the value of your startup.

You’ll see this advice everywhere, even we gave it a few years back. And it’s actually great advice for founders who can pull it off. But in today’s market, the chances that you have that level of interest from VCs is close to zero. It's 2024 now, and the VC feeding frenzy of 2021 is gone.

When you speak to an investor and they ask you what valuation you're raising at, you’ll want to give them an answer that keeps their interest. This means you should not let the market decide and instead, answer with the valuation cap you’re raising at.

Don’t dance around the question and try to pin investors against each other. Simply tell them the valuation cap you’re raising at. If they aren’t happy with the terms, they can always push back.

To ensure your round gains traction, early on you'll want to offer a more enticing valuation cap.

Think $6mm-$8mm. Once your round is committed to, you can increase the valuation cap and expand the size of the round to make room for more investors.

Example of expanding your seed round as you gain traction:

- $500K at $6mm valuation cap (8.33% Dilution)

- $500k at $10mm valuation cap (5% Dilution)

- $500k at $15mm valuation cap (3.33% Dilution)

- Total Seed Round Dilution: 15.82%

If you’ve already pitched an investor at the $6mm valuation cap, it can be tough to ask for $10mm. But you can always say something along the lines of “There was a lot more interest than we anticipated so we had to adjust the raise to make room for more investors.”

If you are interested in a more in depth guide, we cover how to price your Seed round of funding in more detail here.

How to Convince Investors

Before you get started, you HAVE to understand how fundraising really works. It’s no longer just about an amazing pitch or traction, although those obviously help.

If you’ve ever been in sales, you’ll know all about the importance of urgency. Fundraising is no different. Investors will rarely invest without urgency.

In most cases, they’ll simply say they’re very interested but in reality they have no intention of investing. This gives them the option to be kept in the loop and also allows them to maintain the relationship without giving you a “no”.

To avoid this, you’ll need to create urgency.

How do you create urgency?

Creating a fear of missing out (FOMO) is your answer. To put it simply, you want every investor to think that the bus is leaving the station with or without them.

To do this, you’ll need to carefully craft your conversations and talking points. When achieved, you’ll find conversations move faster and investors are willing to commit sooner.

Tactics That Create Investor FOMO

There are a variety of approaches but these are the tactics we find to be most effective for creating urgency.

Tactic #1) Meet in a Narrow Timeframe

To ensure you create FOMO, you’ll want to meet with all of the investors before your raise even begins. This will make it easier to book meetings with them in a narrow time frame when you officially open up your round of fundraising.

If you already have the relationship, you can simply send something like “We’re officially launching our Seed round and would love to hop on a call to kick it off. Is there a time next week that works?”

We recommend blocking off 2 weeks of your calendar with the goal of booking a minimum of 15+ investor meetings within this timeframe.

Tactic #2) Show There is Interest

Simply mentioning that you’ve lined up meetings with other prominent investors will show them that they are not the only investor you are in conversation with.

Some talking points you can rely on are “We have 10 other meetings this week.” or “We have our second meeting with a firm tomorrow morning and they’ve expressed interest in investing.”

If they ask which investors are you talking with, do your best to avoid sharing the name of the investor. You can simply say “Out of respect for them, we’re not sharing any names at the moment but we’re happy to share if you end up joining us in this round.”

Tactic #3) Snowball Commitments

If you are following our advice and offering a lower valuation cap when you start, you can increase the round size to snowball interest. Here’s how it's done:

If you are starting out at a $6mm valuation and raise $500k. You can then increase the cap to $10mm.

In this case, you are now raising $1mm with $500k already committed. This will give investors the feeling that the round is closing quickly and will create a feeling of FOMO.

At this point you can say things like “We’d love to have you in this round but there is a lot of interest. So, if you’d like to participate, please get back soon.”

Now let’s dive into how to run a meeting with investors.

How to Run Investor Meetings

I've already mentioned it multiple times throughout this article, but I'm going to mention it again: fundraising is sales. Just like with sales, trust and relationships are king.

If you want to maximize the odds of converting every investor meeting into a commitment, then you'll want to make that investor your best friend.

Of course, this won't happen on every call, but you should do your best to make it happen. What do I mean by this?

Well, when you meet with investors, don't try to rely on your pitch deck or even try to show your pitch deck. Instead, you should try to build a relationship with that investor through dialogue. If they're having a conversation with you, do not rush to get out of the conversation. Do your best to find things you have in common and make connections with that investor. Make jokes, build rapport, and ultimately build a relationship.

If you can successfully pull this off, these investors are going to trust you, like you, and ultimately be much more willing to back your startup. We all know that we prefer to work with people we like. Investors are no different.

Of course, at some point you’re going to have to pitch your startup. Either with a pitch deck or simply by describing it to an investor. In both cases, you should have a well prepared pitch.

Perfect it by practicing pitching to friends, family, and anyone who has no idea of what it is that you do. Note that many of these people will have no experience in your industry, that’s good. Most investors won’t either so if you can explain your business to your friends, chances are you can explain it to an investor too.

Also keep in mind that you should be able to pitch your startup in 1 sentence, 2 sentences max. If you can’t, this will tell the investor you have not put very much thought into your product or the problem you’re solving. This is actually much more difficult than it sounds so again, practice and reiterate your 1 sentence pitch.

Pitch Examples:

- Bad pitch: LeadLoft helps startups raise capital.

- Bad pitch: LeadLoft is revolutionizing fundraising.

- Good pitch: LeadLoft enables startups to set up and launch a world class fundraising process in just 10 minutes.

Next, let's dive into the specific steps you'll take when you begin the fundraising process using a CRM.

Step #1: Fundraising Preparation

Before you start fundraising, you need to prepare your materials for when investors request more information. Below, we have outlined the specific documents investors will request.

Pitch Deck

When fundraising, skip the business plan and get a Pitch Deck put together. If you don’t already have a pitch deck, we recommend checking out our article on how to build a pitch deck.

Note: If your pitch deck design could use some improvement, hire someone on Fiverr to redesign it. It will cost $30 and will look like a professional designer spent weeks on it. We recommend you use Usamaahsan, he’s extremely talented and we recommend him to all of our customers.

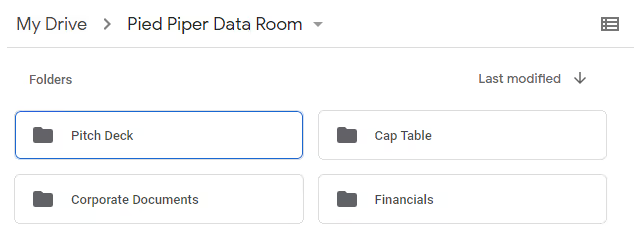

Data Room

When an investor is interested, they’ll begin requesting documents and many will simply ask for a “data room”.

Investors generally like to review your…

- Financials (Balance Sheet, Profit & Loss, Cash Flow)

- Cap Table

- Articles of Incorporation

- And more.

The easiest way to set this up is by using a Google Drive or Dropbox folder, or one of Docsend’s specialized products.

Simply create a folder and upload all relevant documents. Then, whenever an investor asks for the data room, all you have to do is share a link. Beyond the simplicity of a single link, providing a data room will also show investors that you’ve done your research and you’re a prepared founder. Not to mention that you can update the documents in real time too.

If you’d like to learn more about this, we wrote an entire article on fundraising prep and data rooms here.

Terms & Fundraising Documents

It used to be common for early-stage investors to provide the terms of your raise but nowadays, SAFEs are accepted by practically all investors so we recommend sticking to SAFEs for your Seed Round.

I recommend sending your agreement using Docusign or PandaDoc to streamline the signing process as well.

Wire Instructions

You’ll also want to have wire instruction on hand so if/when an investor signs your investment agreement, you can email a simple set of instructions over to them.

If you’d like, you can also include the wire instructions in the Data Room in the form of a Google Doc. From here, you’d simply share a link to the doc and explain that “the wire instructions are outlined here”.

But make sure you have wire instructions on hand before begin your raise. Most of us never or rarely wire money, so plan ahead here.

Step #2: Setting Up Your CRM to Track Investors

When selecting a fundraising CRM, it’s important you choose a software that you can learn and get set up with quickly. It also helps if the platform is purpose-built with fundraising in mind. In almost every case, this is going to be LeadLoft.

LeadLoft is ideal for fundraising because it’s an all-in-one solution that includes an investor database, outreach playbooks (Email & LinkedIn automation), and a simple CRM to track all of your investor conversations.

We recommend it because it will keep things simple. Tools like Salesforce are great but they will be overkill for most sales teams so do yourself a favor and keep your fundraising funnel simple.

LeadLoft launches with most of the setup out of the way, so creating your outreach Playbooks is all that’s really required to start.

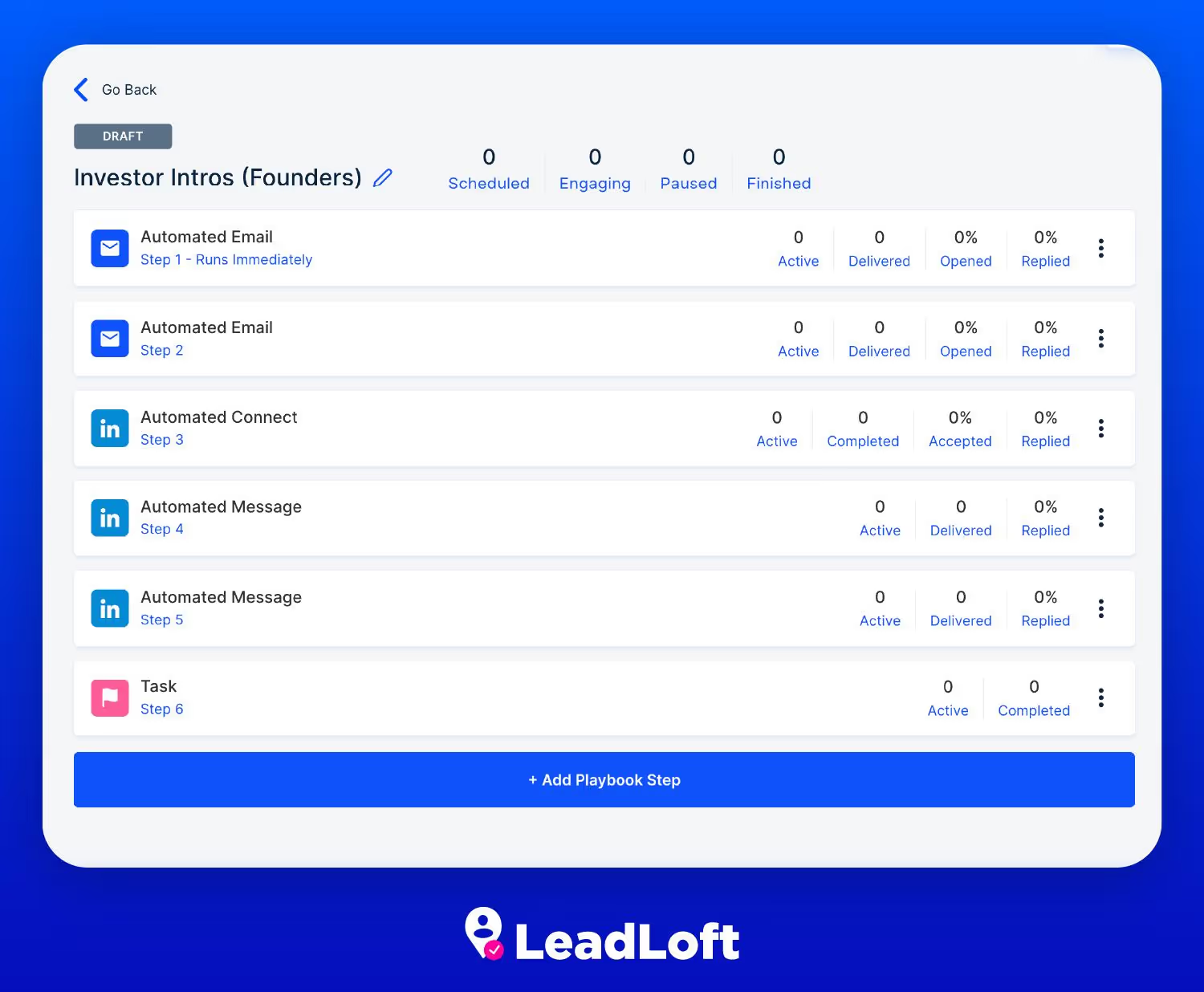

If you don’t already have a large investor network, we recommend creating 2 Playbooks to start:

Playbook A: Introduction Request

This playbook is used to request an introduction to a specific investor. In most cases, this will be sent to founders who were recently backed by investors you are interested in meeting. The goal is to meet with a founder to learn about how they raised their round. Build rapport with the goal of asking for an introduction if it makes sense.

Just keep in mind that this playbook does require a lot of manual work. You'll have to seek out investors, then seek out founders backed by that investor. If you're not interested in a lot of manual work, this playbook probably isn't for you.

Playbook Steps:

- Automated Email: Congrats

- Automated Email: Check back on a time to meet

- Task: Send LinkedIn Connection

- Automated Message: Send LinkedIn Message congratulating them

- Automated Message: Send LinkedIn Message offering to share investor relationships

- Task: Prospect a New Founder Intro

Again, if you’re using LeadLoft, here’s what Playbook A would look like.

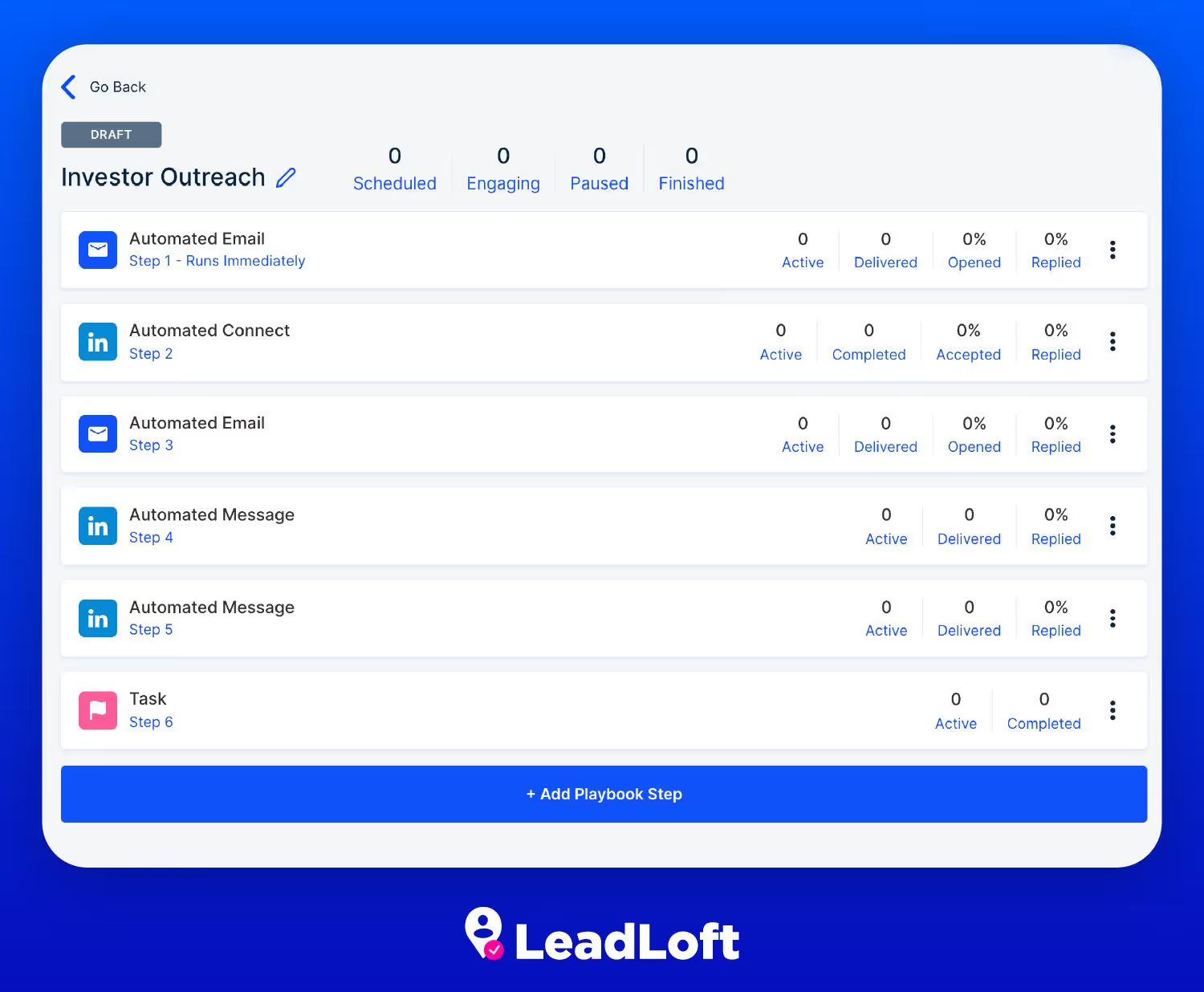

Playbook B: Investor Outreach

This playbook is aimed at starting new conversations with investors. It will likely include your initial pitch, a LinkedIn connection request, and a couple of follow-ups. If you’d like to see some email copy that we’ve tested and know to work, you should check out our investor cold email templates here.

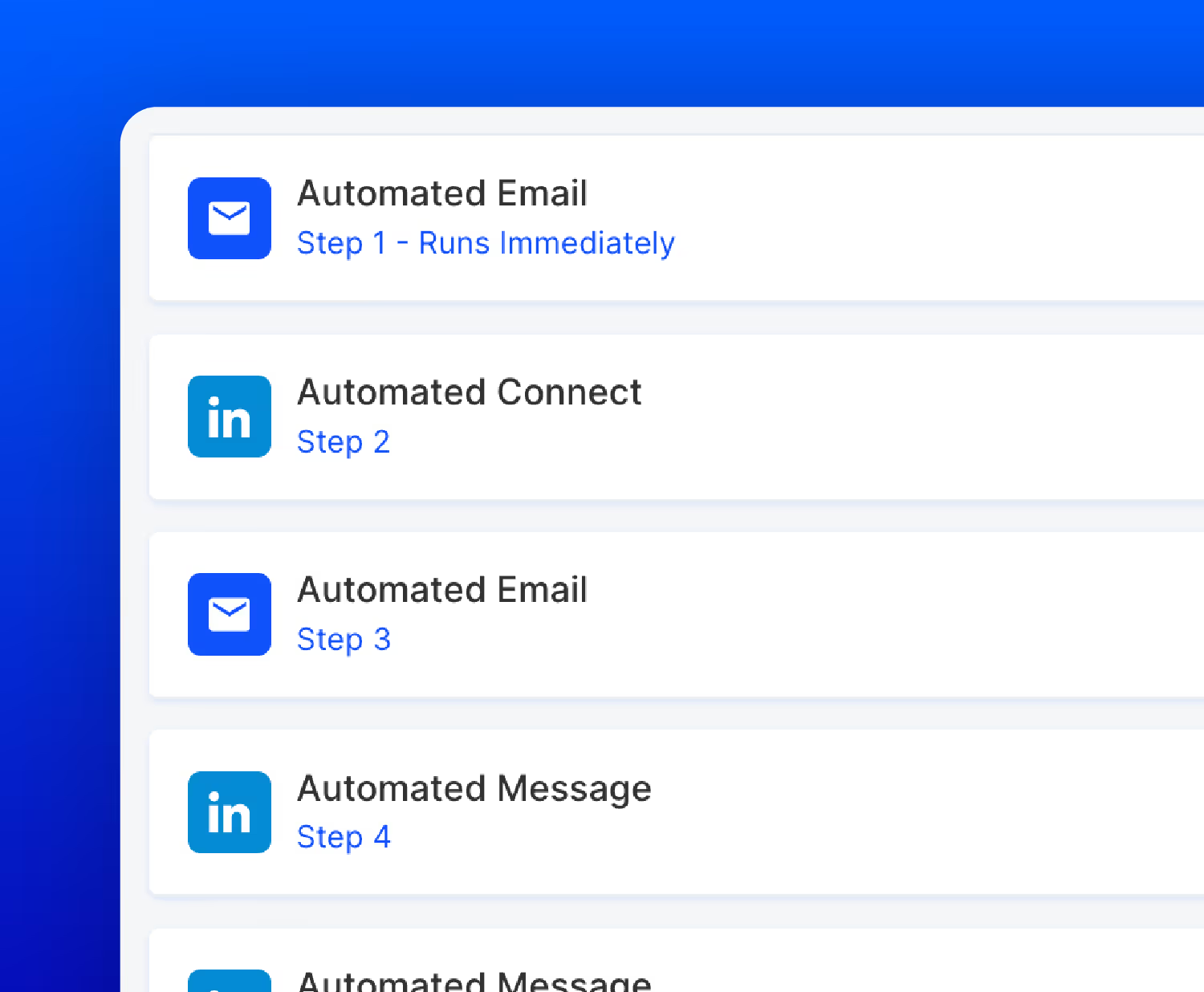

Playbook Steps:

- Automated Email: Introduction and initial pitch

- Automated Connect: Connect on LinkedIn

- Automated Email: Follow up with a short pitch with one update

- Automated Message: Send LinkedIn Message

- Automated Message: Send LinkedIn Message

- Task: If no reply, prospect a new contact from the VC firm & add them to Playbook B

If you’re using LeadLoft, here’s what Playbook B would look like.

Step #3: Reach out to Founders

Next, it's time to expand your founder network. It's important to know that this is most successful when you run it months or even years prior to fundraising. This is because it takes time to build relationships, and reaching out to founders months prior seems much more organic than reaching out to them the day you want an introduction.

So, if you can, try to run this step months before actually launching your fundraising campaign. Otherwise, try to give yourself a few weeks to run this before actually engaging investors. This will give you time to build relationships with founders and ask for an introduction to those investors.

Step #4: Build a List of Investors in Your Network

This is one of the most important steps. If you have a network of investors, this is the time to begin taking inventory. You can use LeadLoft’s LinkedIn prospector to save their emails and accelerate the list-building process.

The goal here is to get a warm introduction to these investors.

If you’re at the Pre-Seed stage, this list can include family and friends too. If you’re at the Seed stage or beyond, only include sophisticated angels and micro VCs in your list.

While building this list do your best to input emails, company names, phone numbers, and anything else that you'll be able to import into your CRM when you begin getting set up.

Step #5: Build a List of Investors to Reach Out to Cold

This is the last step before beginning your outreach. Reaching out to investors cold is an amazing way to add volume to your calendar appointments.

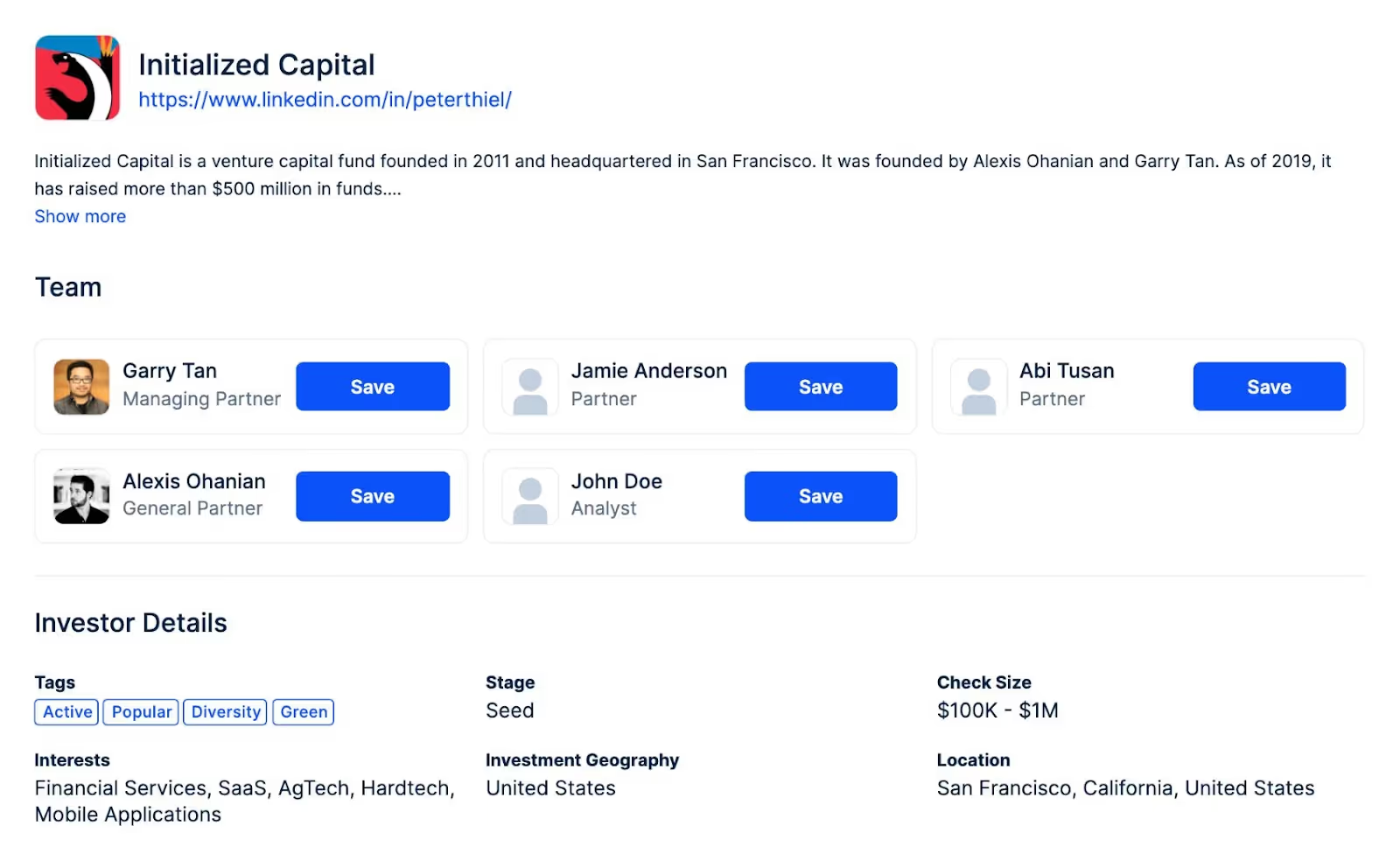

This is where we recommend using LeadLoft’s investor database. You can search and sort through the database to find investors who have invested in your industry in the past. We generally recommend saving multiple partners at every company that you’re planning on reaching out to so you can save time down the road if one partner fails to respond.

Step #6: Manually Reach out to Your Network

This step is extremely important and arguably requires the most time. Since these are your most valuable investor leads, it will be worth it to take additional time if needed to book meetings and build relationships.

This step requires a looser approach because different contacts may require introductions while others may be able to be called directly.

Regardless of the contacts, make sure that you either ask for introductions or contact each investor directly.

The goal is to create a dialogue and let them know that you’re starting your raise in 6-8 weeks. If it feels appropriate, book a time with them to demo or make your pitch in the future. Otherwise, plan to stay in touch and reach out a couple of weeks before the raise starts.

Step #8: Reach out to Investor Cold

Next, it’s time to expand your investor network. The most effective approach is to reach out to investors via cold email. The vast majority of investors are heavy email users and many welcome cold outreach. That being said, personalizing your emails can turn what would have been a cold email into a warm conversation.

Find Investors

You can make your life simple by using LeadLoft to find the investors interested in your industry and stage. When you’ve found the right investors, you can click “Save” and LeadLoft will find and verify the investor’s email address for you automatically.

Engage Investors

Once investors have been saved, you can use the Playbooks we outlined in step 2 to engage them.

The goal here is to just get started. You’ll be shocked to find how responsive investors can be. Many of them care deeply about their reputation, and they will treat all founders (you) with a ton of respect.

Once the campaign goes live, all you’ll have to do is explain to them that you’re going to begin meetings in 6 weeks and you wanted to see if it’s something they’re interested in. If so, ask if you can schedule a time 6 weeks down the road when you’ve started raising to share your pitch deck and meet over Zoom or in person.

Step #9: Pitch Investors

Practice your Pitch

As soon as the 2-week time frame arrives, you’ll want to have a refined pitch and deck. If you haven’t practiced your pitch at this point, you should start.

It’s possible investors will struggle to understand your business, so practice with friends and colleagues who know nothing about your company and are outside of your industry.

Remember to Create FOMO

While you’re pitching, be sure to mention any interest other investors have shown. This cannot be stressed enough, you want to make them feel like they are going to miss out if they don’t close on the raise today. If you have any term sheets offered or follow-up meetings, MENTION THEM!

Step #10: Follow Up & Close Your Raise

Investor emails get cluttered quickly and it’s normal for them to miss an email here and there. If an investor expressed interest in the past, be sure to follow up.

It’s your job to close the raise and there’s no harm in following up with an investor and showing them that you’re organized and serious about raising capital.

Wrapping Up

Hopefully, you’ve found this helpful and will use this strategy to raise capital. From everything we have learned, this guide includes the most effective tactics and tools for raising capital that we’ve seen to date. If you follow all the steps we laid out here, your chances of raising capital are certainly far better.

If you’re in need of some additional help, book a demo with our team and we’ll ensure you’re set up for success.

Good luck with your fundraise!

.avif)

.avif)