Top Startup Investors Ranked: Angels, VCs, & More

.avif)

Finding the right investors can make or break a company.

If you’re able to find the right lead investor, they can bring tons of following investors with them, making it easy to secure the capital you need. If you’re able to find a prestigious investor, then their reputation alone will carry your company through funding rounds for years to come.

Who are these investors though, and how can you get in touch with them?

In this article, we’ve put together the most prestigious investors and investment firms for all shapes and sizes of businesses, and we’ll show you the easiest way to start a conversation with them.

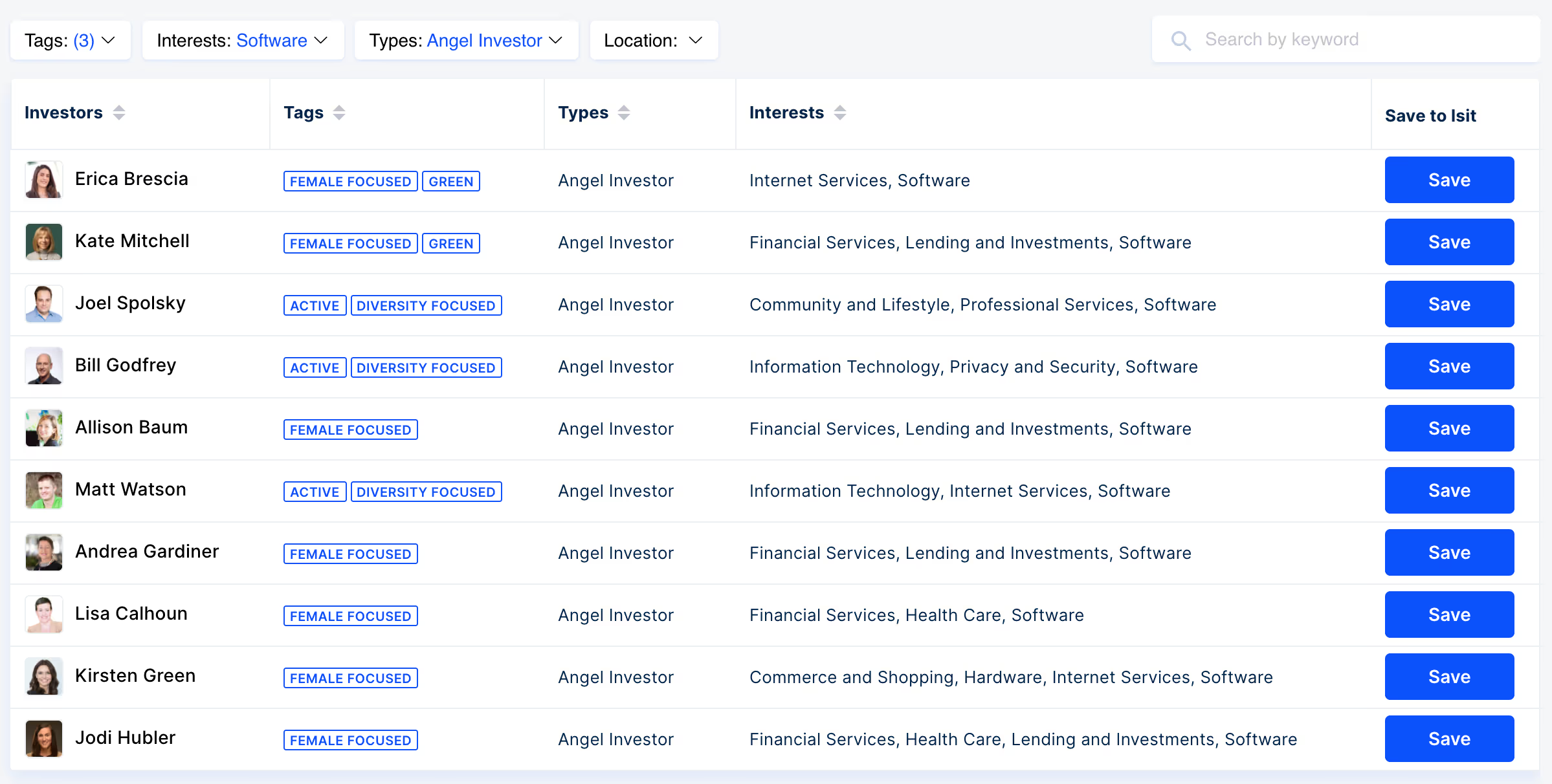

All images and investors are sourced from LeadLoft’s Investor Database.

Top Angel Investors

Angel investors typically invest between $15,000-$250,000, and they will often be the first real investors in your business.

Alexis Ohanian

- Total Exits: 41

- Notable Exits: Snapjoy & Slack

Gary Vaynerchuk (Gary Vee)

- Total Exits: 29

- Notable Exits: Uber & Wildfire (Acquired by Google)

Zach Coelius

- Total Exits: 11

- Notable Exits: YayPay & Cruise

Naval Ravikant

- Total Exits: 56

- Notable Exits: Twitter & Uber

Jason Calacanis

- Total Exits: 48

- Notable Exits: Uber & Zenefits

Top Early Stage VC Firms

Early-stage or Micro-VC firms typically invest in early rounds in amounts between $25,000-$500,000, and their funds are generally sub-$50M.

Lowercase Capital

- Total Exits: 59

- Notable Exits: Slack & Instagram

Acequia Capital

- Total Exits: 39

- Notable Exits: Airbnb & Square

Eniac Ventures

- Total Exits: 50

- Notable Exits: Uber & Boxed

Dorm Room Fund

- Total Exits: 19

- Notable Exits: Young Alfred & Spyce

Great Oaks Venture Capital

- Total Exits: 97

- Notable Exits: Allbirds & Coursehero

Top Venture Capital Firms

Venture capital firms typically invest up to 50% worth of a start-ups’ equity, generally no more than $10M. (Example: If your startup is valued at $15M, the most they would invest is $7.5M.

Sequoia Capital

- Total Exits: 342

- Notable Exits: Reddit & Nvidia

Greycroft

- Total Exits: 106

- Notable Exits: Bird & The RealReal

Andreessen Horowitz

- Total Exits: 187

- Notable Exits: Coinbase & Airbnb

Benchmark

- Total Exits: 176

- Notable Exits: Nextdoor & Riot Games

Top Private Equity Firms

Private equity firms typically buy a 100% ownership stake in the companies they invest in. Private equity firms can invest well over $100M.

The Blackstone Group

- Total Exits: 56

- Total Acquisitions: 136

- Notable Exits: Oatly & Fanatics

The Carlyle Group

- Total Exits: 105

- Total Acquisitions: 166

- Notable Exits: Supreme & Beats Electronics

KKR & Co.

- Total Exits: 87

- Total Acquisitions: 146

- Notable Exits: Box & Pandora

TPG Capital

- Total Exits: 75

- Total Acquisitions: 190

- Notable Exits: Spotify & Etsy

Warburg Pincus

- Total Exits: 127

- Total Acquisitions: 57

- Notable Exits: Airtel & CrowdStrike

Takeaways

It’s exciting to consider your startup as the next Airbnb or Uber, but it’s important to know where these companies started. Without the help of these investors, including the resources and connections gained from the partnership, many of today’s most innovative companies wouldn’t have made it.

When you begin your search for investors on LeadLoft’s Investor Database, make sure you have a good understanding of which funds will be the best match for your business. The information provided by the database can provide you with a good idea of the types of companies a fund invests in, so make sure you’re a good fit before reaching out.

Once you’ve saved a solid list of potential firms, we recommend you cross-check them out on Crunchbase to see their average check size and the companies they’ve invested in previously.

Before reaching out to investors, we highly recommend you check out our complete guide to raising venture capital. In it, we cover the entire process, from fundraising prep to closing your raise.