What to Prepare Before Pitching Investors

.avif)

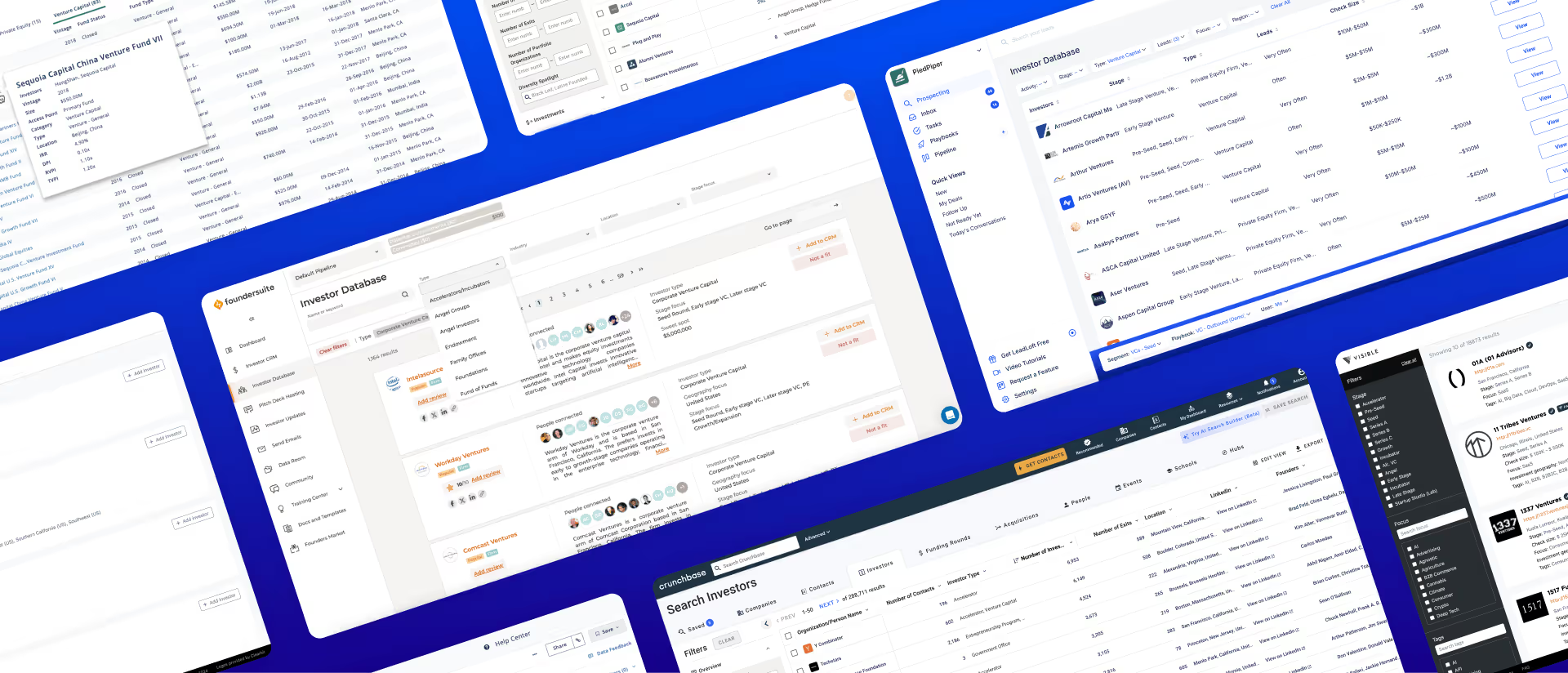

For many startup founders, the world of fundraising is an overwhelming world full of financial jargon that's difficult to understand.

Fortunately, it's far easier to understand than industry veterans lead on. In hopes of helping you to better understand the process of getting funded, I’ll be outlining what a startup founder needs to prepare before approaching or pitching an investor.

1) Investor Pitch Deck

Having helped companies connect with investors at scale we know exactly what investors require upfront. For 90% of investors, whether angels or VCs, they’ll require a pitch deck before they agree to hop on a call.

In general, the pitch deck needs to be simple, clearly outline the company vision, and highlight any traction gained thus far. We recommended reading one of our past articles if you’d like to learn more about building an amazing pitch deck. You can also download a free pitch deck template here to get a head start on the pitch deck structure and design.

2) Terms of the Raise & Investor Agreement

If the investor is interested they’ll want to know how much you’re looking to raise and under what terms.

What terms do most startups use to raise capital?

Most startups raise capital with different variations of convertible notes. If you don’t already know, a convertible note is essentially a promise to give an investor ownership in the future.

This leaves the complexity and negotiations involved in valuing a company for future rounds of fundraising.

Below is one of the most popular agreements used by startups in the silicon valley. It’s similar to convertible notes but operates as a simple standardized version.

The “SAFE” by Y Combinator (open-sourced)

What is a SAFE?

The SAFE (Simple Agreement for Future Equity) is a simple, as the title explains, way to promise equity to investors in the future, generally with a valuation cap (most common), discount rate, or combination of the two.

Download Y Combinator's SAFE agreements here.

Disclaimer: LeadLoft does not endorse or assume any responsibility for the use of these documents.

Why is the SAFE so popular?

- It’s well known by investors across the world.

- It’s a simple contract that almost anyone can read and understand.

- It’s open sourced which makes it very affordable to offer as few or no lawyers are needed to approach investors.

- There are fewer terms to negotiate, accelerating fundraising negotiations.

What is a valuation cap?

Eventually the investment will have to convert into ownership. This occurs once there’s an equity financing round, acquisition, or other equity event. The valuation cap places a limit on the valuation when that conversion into ownership eventually takes place.

What is a discount rate?

As mentioned above, the investment will eventually be transferred into ownership in the future. When that conversion takes place, the investor will receive a discount on the share price relative to everyone else. If the company raises capital for $1/ share and you previously agreed to offer a discount rate of 80%, the investors original investment will convert into ownership at a rate of $0.80 per share instead of $1 per share.

3) Data Room

As soon as an investor is interested they’ll begin digging to learn more about your company. This means reviewing financials, corporate documents, and more.

It’s best to set up a “Data Room”, as it’s called, to streamline this process. Instead of searching for the correct documents and sending them over one at a time, you can send a shared link in an email and provide everything needed at once.

What should the Data Room include?

- Certificate of Incorporation

- Financials (P&L & Balance Sheet)

- Investment Agreement (e.g. SAFE, convertible note, or whichever you’re using.)

You can always add more but the above items are the bare minimum.

4) Keep Wire Transfer Instructions on Hand

Once you've close a deal and agreements have been signed, the next step is for the investor, VC or otherwise, to transfer the funds.

How do investors transfer money?

It's well known that both VCs and angel investors rely almost exclusively on wire transfers to move funds around.

Wire transfer are the obvious choice when sending money to a newly added portfolio company, especially when the size of the transfer is considered.

Conclusion

Hopefully by now we’ve simplified the process of raising capital. The next step is to get out there and start meeting with investors. If you need help connecting with investors, feel free to contact our team. We’ll work with you to set up a proven process to book meetings with investors at scale.

.avif)