How to Raise $5M Under Reg CF

Raising capital under regulation crowdfunding is not a simple task. It's different than most fundraising. Traditional fundraising consists of sitting down with a single investor and trying to convince them to commit to an investment.

Regulation crowdfunding is so different from traditional fundraising that I recommend taking a completely different approach. In fact, I personally consider it to be more similar to e-commerce marketing than any other form of fundraising.

If you're looking to get your regulation crowdfunding raise up to a million dollars or more, you'll have to treat your marketing efforts like you're an e-commerce site.

Below, I will be covering all the best tactics for fundraising under Reg CF as well as some newer tactics that we offer through our service LeadLoft. If you have any questions or would like to learn more about the tactics we recommend or have found success with, feel free to reach out. We love hearing from founders and are more than happy to help where we can.

Tactics to Get You Over $5M

Digital Ads

Anyone in e-commerce understands that there's a lot as a core part of the business. In fact, if you’re a positive return on ad spend (ROAS) company in the e-commerce space, you're able to get loans upwards of ten million dollars from companies like ClearBanc. This is because digital ads are almost infinitely scalable. Regulation crowdfunding is no different. If you are able to raise capital at a very profitable rate, you are able to continue scaling, this is especially true under reg D.

Regarding your regulation crowdfunding campaign, it's best to treat your campaign page as a landing page, your investment page like a checkout page, and the thank-you page like a conversion page. If you understand this, you will be able to correctly track which prospecting efforts are driving the most valuable traffic, who is interested, and the return on ad spend. Having this clear vision allows you to continually optimize and adjust ads until all that is required to receive an investment is turning on a digital ad campaign.

Email Newsletter

Interested investors oftentimes sign up and possibly give their email to you. This is them taking the first step to invest or to simply learn more. Take this as a serious interest in your company and follow up. If they're seriously interested, they’ll likely be interested in learning more. Contact hem and offer to hop on a call and do what entrepreneurs do best, sell their ideas!

Landing Page Optimization

Although Reg CF is overseen by the SEC, this does not mean you can have a fun and inviting landing page that outlines the many benefits of investing in your service. Be sure to immediately mention the highlights of your company and to select the platform with a landing page that's optimized for conversions.

Investor Outreach

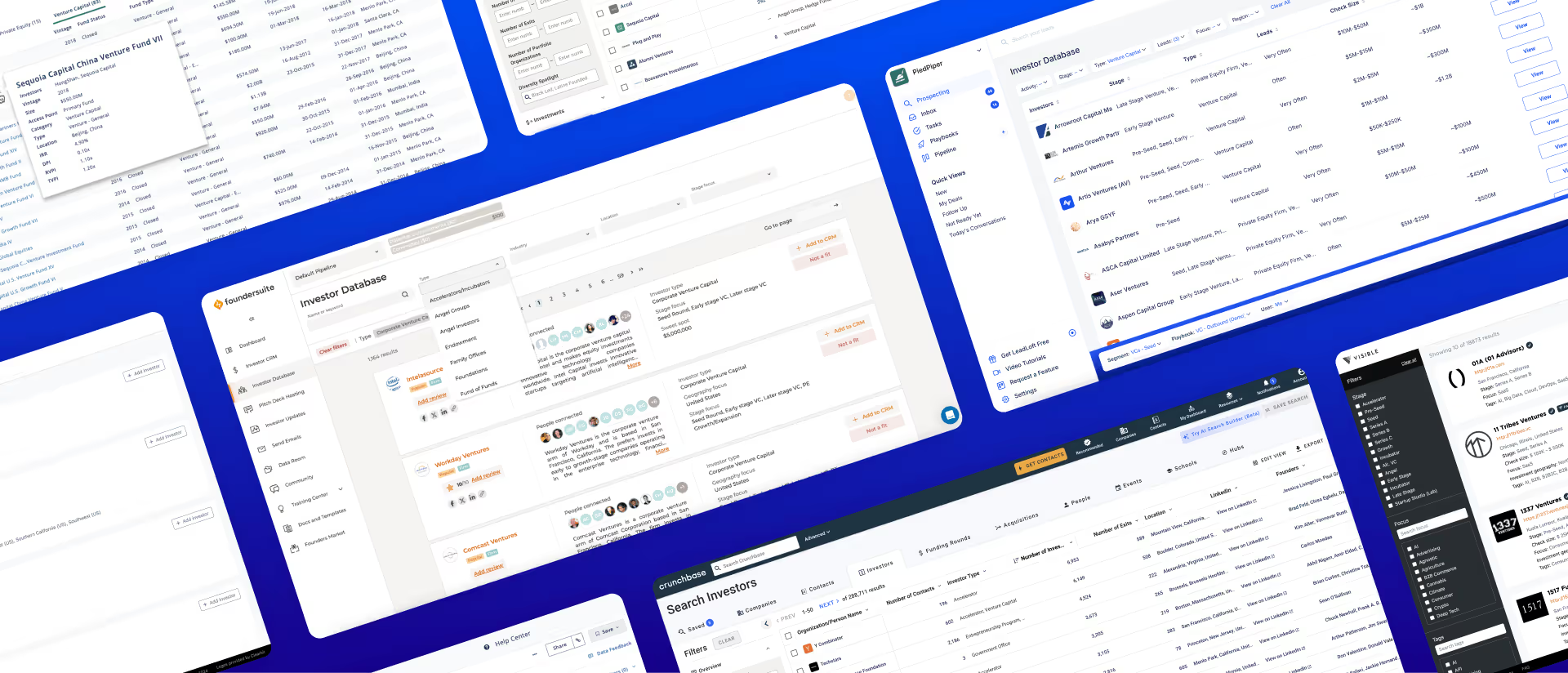

Reaching out to notable investors is also a great way to draw investment. To do this, you'll have to reach out through and faster Networks, social networks, and other services that offer access to investor data like LeadLoft.

Through these channels, you can find investors and start investor negotiations. Although the hit rate is generally low, the investment amount is very large. This tactic is best for companies confident in their revenue number, community, idea, and team. If you’re one of these companies and are interested in learning more about this route, feel free to contact the LeadLoft team here.

Community Outreach

If you're raising under regulation crowdfunding you likely have a large community that you can tap into. The best way to tap into this is your current newsletter, website, POS systems, and company events.

Own the fact that you’re raising capital and ask your community to join. Giving them a small stake in your company will only make for more loyal customers.

Conclusion

There are thousands of ways you can raise Capital. Under regulation crowdfunding, it's important to understand traditional methods of raising Capital don't work. You have to tap into modern marketing tactics like digital marketing, cold email marketing (LeadLoft), newsletter marketing, and even grassroots efforts.

If you find yourself needing help, we'll be here. Good luck!